Portfolio Management Services

Portfolio Management Services Specification

- Client Support

- 24x7 Assistance

- Service Mode

- Online/Offline

- Risk Profile Assessment

- Available

- Investment Strategy

- Customized Allocation

- Regulatory Compliance

- SEBI Registered

- Service Type

- Portfolio Management Services

- Asset Classes Covered

- Equity, Debt, Alternative Investments

- Fee Structure

- Fixed and Performance-Based

- Performance Reporting

- Quarterly & Annual

- Dedicated Relationship Manager

- Provided

- Consultation Type

- Personalized

- Digital Access

- Secure Online Portal

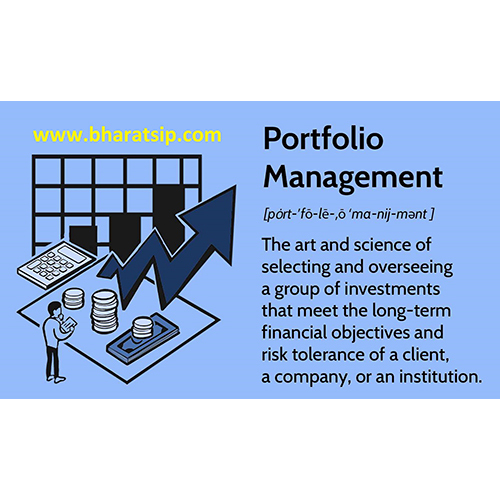

About Portfolio Management Services

Add to Cart and procure opulent Portfolio Management Services, crafted for those seeking enviable returns with inestimable value. Our top-rated suite includes Risk Profile Assessment, quarterly and annual performance reporting, and coverage across Equity, Debt, and Alternative Investments. The fee structure is both fixed and performance-based, ensuring competitive pricing with optimal service value. Benefit from a dedicated Relationship Manager and 24x7 client support. Experience SEBI-registered regulatory compliance, secure digital access, and the flexibility of online/offline personalized consultations from a reputed service provider in India.

Premier Portfolio Management Services: Applied Across Diverse Investments

Used by high-net-worth individuals and discerning investors, our Portfolio Management Services excel on the surface of application, including equities, debt, and alternative assets. Special features include personalized investment strategies, comprehensive risk profile assessment, and direct access to a dedicated manager. Optimal for clients demanding security and innovation, this service combines expertise and technology for reliable, custom portfolio growth.

Payment Terms and Supply Ability in Portfolio Management Services

Portfolio Management Services offer flexible payment terms, featuring both list price structures and performance-based fees aligned with market value and asset exchange. Service supply ability is robust, available across all major domestic markets in India. With transparent pricing and secure online/offline consultations, clients benefit from easy procurement and ongoing access to portfolio updates, ensuring seamless experience and support throughout their investment journey.

Premier Portfolio Management Services: Applied Across Diverse Investments

Used by high-net-worth individuals and discerning investors, our Portfolio Management Services excel on the surface of application, including equities, debt, and alternative assets. Special features include personalized investment strategies, comprehensive risk profile assessment, and direct access to a dedicated manager. Optimal for clients demanding security and innovation, this service combines expertise and technology for reliable, custom portfolio growth.

Payment Terms and Supply Ability in Portfolio Management Services

Portfolio Management Services offer flexible payment terms, featuring both list price structures and performance-based fees aligned with market value and asset exchange. Service supply ability is robust, available across all major domestic markets in India. With transparent pricing and secure online/offline consultations, clients benefit from easy procurement and ongoing access to portfolio updates, ensuring seamless experience and support throughout their investment journey.

FAQ's of Portfolio Management Services:

Q: How does the risk profile assessment process work in your portfolio management services?

A: Risk profile assessment is conducted during onboarding, where we evaluate your financial goals, investment horizon, and risk tolerance. Expert advisors then tailor a strategy matching your profile to ensure optimal portfolio allocation across asset classes.Q: What asset classes are covered under the portfolio management offering?

A: Our service encompasses equities, debt instruments, and alternative investments. Allocation is customized for each client, ensuring diversification and alignment with individual financial objectives and risk appetite.Q: When are performance reports delivered to clients?

A: Clients receive comprehensive performance reports on a quarterly and annual basis. These detailed reports provide insights into your portfolio's progress and performance against benchmarks.Q: Where can clients access their portfolio updates and service features?

A: Clients benefit from secure online portal access. All service features, updates, and portfolio summaries are easily accessed digitally, complemented by 24x7 client support.Q: What is the benefit of having a dedicated relationship manager in this service?

A: A dedicated relationship manager offers personalized guidance, addresses queries promptly, and ensures your investment strategy is consistently monitored and adjusted according to market changes and personal objectives.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Mutual Funds Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry