Online Mutual Funds

Online Mutual Funds Specification

- Platform Compatibility

- Web and Mobile Devices

- Customer Guidance

- Investment Advisory Available

- Portfolio Tracking

- Real-time Online Dashboard

- Minimum Redemption Period

- Subject to respective fund rules

- Tax Benefits

- Available as per Applicable Schemes

- Payment Modes Accepted

- Online Banking, UPI, Debit Card

- Account Opening Time

- Instant (Subject to KYC)

- Data Security

- SSL Encrypted Transactions

- Language Support

- Multiple Indian Languages

- Regulatory Compliance

- SEBI Registered

About Online Mutual Funds

Experience the astounding convenience of investing in online mutual funds with our SEBI-registered platform, compatible with both web and mobile devices. Open your account instantly upon successful KYC, and enjoy secure, SSL-encrypted transactions across payment modes including online banking, UPI, and debit cards. Gain stellar access to real-time portfolio tracking through a highlighted dashboard, with comprehensive support in multiple Indian languages. Redeem your investments following fund-specific minimum redemption periods and enjoy unbeatable tax benefits where applicable. Expert investment advisory and regulatory compliance ensure your journey is hassle-free and rewarding.

Online Mutual Funds: Versatile Investment Tool

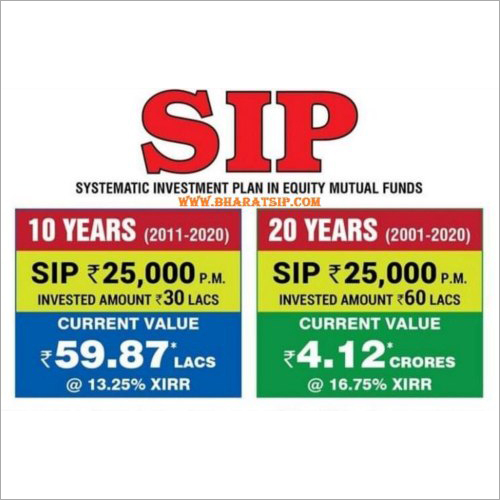

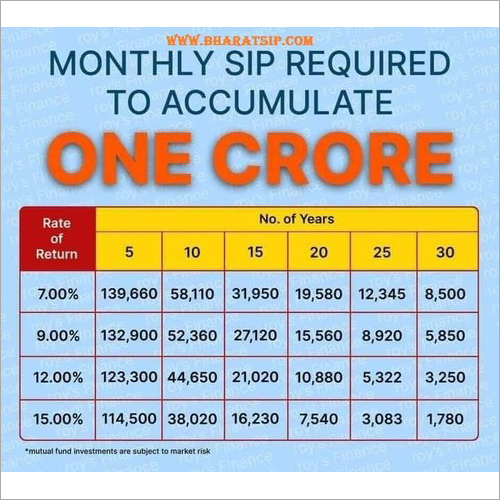

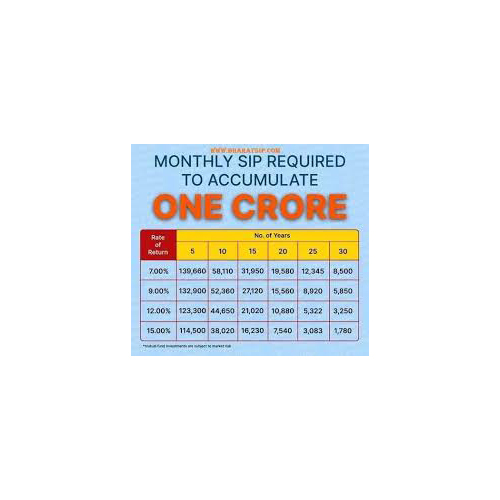

Online mutual funds serve a wide array of investment objectives, catering to both new and experienced investors. Specifically used for wealth creation, they find application in goal-based financial planning, retirement solutions, and short- or long-term savings. With easy access through web and mobile platforms, users can redeem their units as per the respective fund rules. Their highlighted utility lies in being a flexible option for individuals seeking hassle-free, diversified investment solutions.

Reliable Supply and Easy Sample Access

With a robust supply ability, our online mutual fund services are readily handed over to investors nationwide. Main export markets include various Indian cities, and quotations for bulk advisory services are available upon request. For first-time users, a demo or sample account can be provided to experience the platform. Expect quick dispatch of onboarding details and prompt assistance to ensure a seamless start to your investment journey.

Online Mutual Funds: Versatile Investment Tool

Online mutual funds serve a wide array of investment objectives, catering to both new and experienced investors. Specifically used for wealth creation, they find application in goal-based financial planning, retirement solutions, and short- or long-term savings. With easy access through web and mobile platforms, users can redeem their units as per the respective fund rules. Their highlighted utility lies in being a flexible option for individuals seeking hassle-free, diversified investment solutions.

Reliable Supply and Easy Sample Access

With a robust supply ability, our online mutual fund services are readily handed over to investors nationwide. Main export markets include various Indian cities, and quotations for bulk advisory services are available upon request. For first-time users, a demo or sample account can be provided to experience the platform. Expect quick dispatch of onboarding details and prompt assistance to ensure a seamless start to your investment journey.

FAQs of Online Mutual Funds:

Q: How do I open an account to invest in online mutual funds?

A: You can open an account instantly by completing the KYC process on our web or mobile platform. Once verified, you can begin investing right away.Q: What payment methods are accepted for mutual fund purchases?

A: We accept online banking, UPI, and debit card payments to make your funding process flexible and convenient.Q: When can I redeem my mutual fund units?

A: Redemption is allowed as per the minimum period set by the respective mutual fund scheme you invest in. Please check specific fund rules for details.Q: Where can I track my investment portfolio?

A: You can access a real-time online dashboard that highlights your portfolios performance across both web and mobile platforms.Q: What are the tax benefits of investing in these funds?

A: Tax benefits are available as per applicable schemes, such as under Section 80C for ELSS funds. Please consult our advisory team for personalized guidance.Q: How is my data secured on your platform?

A: All transactions are SSL-encrypted, ensuring robust security for your personal and financial data.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Mutual Funds Category

Online Mutual Funds Sip Systematic Investment Plans

Price 500 INR / Set

Minimum Order Quantity : 1 Set

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry