elss vs pf bs

elss vs pf bs Specification

- Returns (ELSS)

- Market Linked, Potentially Higher

- Investment Type (ELSS)

- Equity Linked Savings Scheme

- Returns (PF/BS)

- Fixed, Lower

- Suitability (ELSS)

- Aggressive Investors Seeking High Returns

- Tax Benefit (ELSS)

- Section 80C, Up To Rs 1.5 Lakh

- Who Can Invest (ELSS)

- Individuals, HUFs

- Risk (PF/BS)

- Low

- Lock-in Period (PF/BS)

- 5-15 Years

- Minimum Investment Amount (PF/BS)

- No Minimum for Bank Savings, As per Scheme for PF

- Suitability (PF/BS)

- Conservative Investors Seeking Safety

- Premature Withdrawal (ELSS)

- Not Allowed Before Lock-in

- Tax Benefit (PF/BS)

- Section 80C, Up To Rs 1.5 Lakh

- Investment Type (PF/BS)

- Provident Fund/Bank Savings

- Liquidity (ELSS)

- Low (Lock-in Applies)

- Returns Taxability (PF/BS)

- Interest from PF is Tax-Free, Bank Savings Interest is Taxable

- Risk (ELSS)

- High

- Who Can Invest (PF/BS)

- Salaried Individuals (PF), Anyone (BS)

- Returns Taxability (ELSS)

- Long Term Capital Gains Tax Applies

- Lock-in Period (ELSS)

- 3 Years

- Minimum Investment Amount (ELSS)

- Rs 500

- Premature Withdrawal (PF/BS)

- Restricted in PF, Allowed in BS

- Liquidity (PF/BS)

- Very Low (Long Lock-in)

About elss vs pf bs

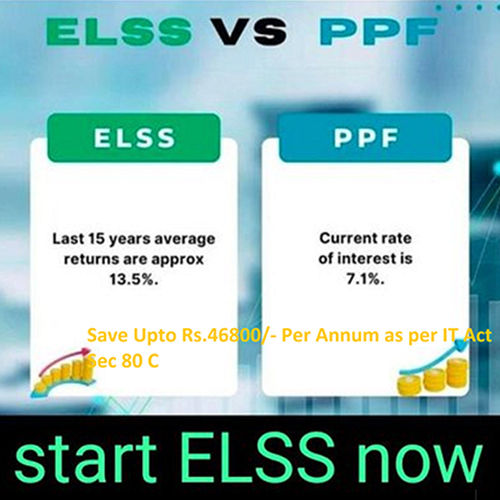

Take advantage of the famed ELSS (Equity Linked Savings Scheme) and dominant PF/Bank Savings plans to fulfill diverse investment goals. ELSS is a prime choice for aggressive investors seeking higher, market-linked returns with a minimum investment of Rs 500, while PF/BS offer fresh and steady returns with scarce risk and flexible investment requirements. While ELSS has a 3-year lock-in and capital gains tax, PF assures tax-free interest and long lock-in periods. Both options provide Section 80C tax benefits, catering to distinct investor preferences across India.

Key Features & Applications

ELSS vs PF/BS offers a robust mix of investment features. Designed for individual and HUF investors, ELSS uses a market-linked mechanism ideal for aggressive usage, while PF and Bank Savings benefit conservative investors. Suited for various plant applications, PF/BS are acclaimed for their fixed returns and low risk profile, making them a solid feature in financial plans. With acclaimed service providers in India, both schemes help shape dominant investment strategies.

Export, Certifications, and Delivery Process

India's ELSS and PF/BS products serve prominent export markets with efficient transport services. Packing & dispatch procedures ensure safe handling and timely exchanges. Certifications, such as Section 80C compliance, establish credibility in domestic and international markets. The delivery time for PF is governed by scheme norms, while bank savings offer instant liquidity. ELSS requires a 3-year lock-in before redemption, with seamless documentation supported by service providers, modern packing, and reliable transport infrastructure.

Key Features & Applications

ELSS vs PF/BS offers a robust mix of investment features. Designed for individual and HUF investors, ELSS uses a market-linked mechanism ideal for aggressive usage, while PF and Bank Savings benefit conservative investors. Suited for various plant applications, PF/BS are acclaimed for their fixed returns and low risk profile, making them a solid feature in financial plans. With acclaimed service providers in India, both schemes help shape dominant investment strategies.

Export, Certifications, and Delivery Process

India's ELSS and PF/BS products serve prominent export markets with efficient transport services. Packing & dispatch procedures ensure safe handling and timely exchanges. Certifications, such as Section 80C compliance, establish credibility in domestic and international markets. The delivery time for PF is governed by scheme norms, while bank savings offer instant liquidity. ELSS requires a 3-year lock-in before redemption, with seamless documentation supported by service providers, modern packing, and reliable transport infrastructure.

FAQ's of elss vs pf bs:

Q: How does the minimum investment amount differ between ELSS and PF/BS?

A: ELSS requires a minimum investment of Rs 500, while bank savings have no minimum, and PF varies as per the scheme.Q: What are the tax benefits available for ELSS and PF/BS investments?

A: Both ELSS and PF/BS offer tax benefits under Section 80C, up to Rs 1.5 lakh, but returns taxability differs. ELSS attracts long-term capital gains tax, PF interest is tax-free, while bank savings interest is taxable.Q: When is premature withdrawal permitted in ELSS and PF/BS?

A: Premature withdrawal is not allowed before the 3-year lock-in for ELSS. PF allows restricted withdrawals depending on the scheme, while bank savings permit free withdrawals.Q: Where can investors purchase ELSS and PF/BS products in India?

A: ELSS is available via mutual fund providers, while PF can be accessed through employers and recognized institutions. Bank savings are available at most banks across India.Q: What is the process for investing in ELSS compared to PF/BS?

A: To invest in ELSS, investors can apply online or through mutual fund distributors, meeting the Rs 500 minimum. PF investments usually occur via payroll, controlled by employers, while bank saving accounts require basic KYC procedures.Q: What benefit do ELSS and PF/BS provide to investors?

A: ELSS offers high return potential for aggressive investors; PF/BS guarantee capital safety and fixed income for conservative profiles, with both options qualifying for major tax deductions.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

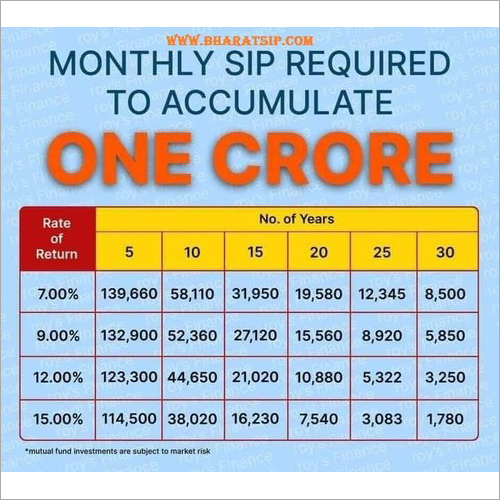

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry