E Flat For Sale Insurance Service

MOQ : 1 Unit

E Flat For Sale Insurance Service Specification

- Insurance Policy Type

- E Flat For Sale Insurance Service

- Service Location/City

- Pan India

- Type Of Insurance

- Property Insurance

- Payment Mode

- Online/Offline

- Mode Of Service

- Online

- Service Period

- Yearly

E Flat For Sale Insurance Service Trade Information

- Minimum Order Quantity

- 1 Unit

- Supply Ability

- 100 Units Per Week

About E Flat For Sale Insurance Service

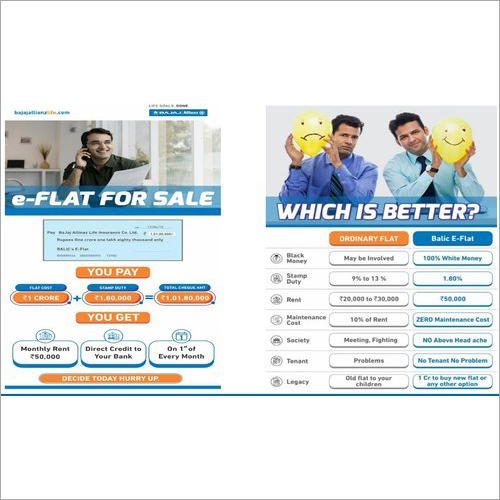

E Flat For Sale Insurance Service is a type of insurance service that provides coverage for a property that is for sale, such as an apartment or a flat. The service is designed to protect the property against risks such as theft, fire, or natural disasters. The insurance policy covers the property until it is sold, and the coverage may include damage to the property, liability protection, and loss of rent coverage. E Flat For Sale Insurance Service helps property owners mitigate the risks of owning a property that is vacant or not occupied and provides financial protection during the sales process.

Comprehensive Protection for E Flats

Our E Flat For Sale Insurance Service delivers all-encompassing coverage for your property, addressing risks such as fire, theft, natural disasters, and accidental damages. Designed specifically for flats on the market, it helps ensure your assets are protected during the sales process, minimizing potential financial setbacks from unforeseen events.

Easy and Convenient Online Service

Apply for and manage your E Flat For Sale Insurance policy entirely online. From obtaining quotes to application, payment, and renewal, the process is seamless and efficient. Both online and offline payment options are available, catering to your preference and convenience, regardless of your location within India.

FAQ's of E Flat For Sale Insurance Service:

Q: How do I apply for the E Flat For Sale Insurance Service online?

A: To apply, visit the service provider's official website and select the E Flat For Sale Insurance option. Fill out the required property details, choose your policy, and complete the payment using your preferred mode. The process is fully digital, allowing for quick and easy application from anywhere in India.Q: What exactly does the E Flat For Sale Insurance cover?

A: This policy provides property insurance for E flats listed for sale, offering protection against risks including fire, burglary, natural disasters, and accidental damages. Review the specific inclusions and exclusions in your policy for detailed coverage information.Q: When does my insurance coverage begin and how long is it valid?

A: Coverage starts once your application is approved and payment is confirmed. The insurance is valid for one year from the start date, with the option to renew annually for uninterrupted protection.Q: Where is the E Flat For Sale Insurance Service available in India?

A: The service is offered Pan India, making it accessible to property owners and sellers in any city or region across the country.Q: What is the process for filing a claim under this policy?

A: In the event of a covered incident, report the claim online through the provider's portal or contact their support team. Submit the required documents and follow the outlined instructions to ensure prompt processing and resolution.Q: Can I use both online and offline payment methods for this insurance?

A: Yes, you may choose either online payment through secure digital gateways or offline payment as per your convenience when purchasing or renewing your policy.Q: What are the key benefits of choosing this property insurance for my E flat?

A: This insurance offers tailored protection for flats on sale, safeguards your investment, ensures compliance during the sales period, and provides peace of mind knowing that your property is covered against unexpected events.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry