Online Health Insurance Mediclaim Policy Service

Online Health Insurance Mediclaim Policy Service Specification

- Renewal Option

- Annual Renewal Available

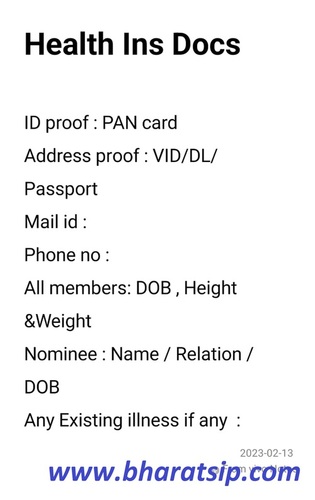

- Documentation Required

- ID Proof, Address Proof, Medical History

- Service Mode

- Online

- Payment Mode

- Online/Offline

- Sum Insured Options

- 1 Lakh to 10 Lakh

- Eligibility

- Indian Residents, Age 18-65 years

- Policy Coverage

- Hospitalization Expenses, Pre and Post Hospitalization, Daycare Procedures, Ambulance Charges, Cashless Facility at Network Hospitals

- Support Availability

- 24/7 Customer Support

- Tax Benefit

- Eligible for tax benefits under Section 80D

- Claim Process

- Online Submission and Tracking

- Family Cover

- Individual & Family Floater Plans Available

- Policy Term

- 1 year, Renewable

- Service Type

- Online Health Insurance Mediclaim Policy Service

- Location

- Pan India

About Online Health Insurance Mediclaim Policy Service

Discover our cost-effective Online Health Insurance Mediclaim Policy Service, highly recommended for individuals and families seeking comprehensive coverage. Enjoy top-notch protection for hospitalization expenses, pre and post-hospitalization, daycare procedures, ambulance charges, and cashless facility at esteemed network hospitals across India. This redoubtable service is suitable for Indian residents aged 18-65 years and offers both individual and family floater plans. Benefit from a superb online submission and tracking system, 24/7 customer support, annual renewal, and flexible sum insured options from 1 lakh to 10 lakh. Shop now and secure peace of mind with added tax advantages!

Why Opt for Our Online Health Insurance Mediclaim Policy Service?

Our Online Health Insurance Mediclaim Policy Service is suitable for both individuals and families, offering special features like cashless treatment at network hospitals, online claim management, and flexible payment modes. The competitive advantages include a wide choice of sum insured options, superb customer support available round-the-clock, and a renewal option that ensures continued coverage. This policy supports those seeking a reliable, all-digital solution for health insurance needs in a seamless, hassle-free manner.

Export Markets, Samples, and Delivery Options for Online Mediclaim Policy Service

We offer our top-notch Online Mediclaim Policy Service to a growing main export market, including NRIs with dependents in India. Clients rate our service highly for its prompt processing and exceptional coverage. Express shipping of policy documents is available, and sample policy details can be provided on request. We deliver policy activation swiftly upon confirmation, ensuring you never experience delays in coverage. Take advantage of our limited-time offer - get covered today with rapid policy issuance!

Why Opt for Our Online Health Insurance Mediclaim Policy Service?

Our Online Health Insurance Mediclaim Policy Service is suitable for both individuals and families, offering special features like cashless treatment at network hospitals, online claim management, and flexible payment modes. The competitive advantages include a wide choice of sum insured options, superb customer support available round-the-clock, and a renewal option that ensures continued coverage. This policy supports those seeking a reliable, all-digital solution for health insurance needs in a seamless, hassle-free manner.

Export Markets, Samples, and Delivery Options for Online Mediclaim Policy Service

We offer our top-notch Online Mediclaim Policy Service to a growing main export market, including NRIs with dependents in India. Clients rate our service highly for its prompt processing and exceptional coverage. Express shipping of policy documents is available, and sample policy details can be provided on request. We deliver policy activation swiftly upon confirmation, ensuring you never experience delays in coverage. Take advantage of our limited-time offer - get covered today with rapid policy issuance!

FAQ's of Online Health Insurance Mediclaim Policy Service:

Q: How can I purchase the Online Health Insurance Mediclaim Policy?

A: You can conveniently purchase the policy online by submitting required documentation such as your ID proof, address proof, and medical history. Select your preferred sum insured, make payment via online or offline mode, and receive instant coverage confirmation.Q: What coverage does the policy offer to policyholders?

A: The mediclaim policy covers hospitalization expenses, pre and post hospitalization, daycare procedures, ambulance charges, and provides cashless facility at network hospitals throughout India. Both individual and family floater plans are available, with sum insured options from 1 lakh to 10 lakh.Q: When can I renew my health insurance mediclaim policy?

A: Your policy can be renewed annually. We provide timely reminders and a user-friendly online renewal process, ensuring uninterrupted coverage year after year.Q: Where can I use the cashless facility provided by this policy?

A: The cashless facility is available at a vast network of partnered hospitals across India. You can check the list of network hospitals at the time of policy issuance or on our service provider's website.Q: What is the process for submitting and tracking claims online?

A: Just log in to our digital portal, fill out the online claim form, upload necessary documents, and submit. You can easily track the status of your claim in real-time on the platform.Q: What benefits do I receive apart from health coverage?

A: In addition to comprehensive health coverage, policyholders can avail tax benefits under Section 80D of the Income Tax Act, supplementary family cover options, and responsive 24/7 customer support for all your queries and needs.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Health Insurance Services Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry