Multibrand Health Insurance Plans Online

Price 20000 INR/ Set

MOQ : 1 Set

Multibrand Health Insurance Plans Online Specification

- Payment Modes

- Credit Card, Debit Card, Net Banking, UPI

- Online Purchase

- Available

- Claim Process

- Digital claim submission portal

- Inclusive Benefits

- Cashless Hospitalization, Preventive Health Checkup, Pre & Post hospitalization coverage

- User Interface

- Easy comparison and selection dashboard

- Available Brands

- Multiple leading insurance brands

- Coverage Amount

- Customizable as per requirement

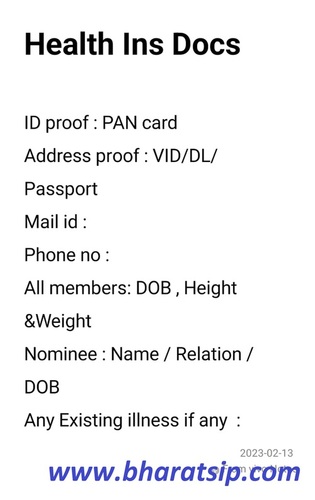

- Document Requirement

- Basic identification documents

- Policy Issuance Time

- Instant policy issuance on successful payment

- Eligibility

- Available to Indian residents aged 18 to 65 years

- Renewal Option

- Online renewal available

- Premium Flexibility

- Monthly, Quarterly, Annual payment modes

- Claim Settlement

- Fast and hassle-free

- Customer Support

- 24x7 support available

- Product Name

- Multibrand Health Insurance Plans Online

- Policy Types

- Individual, Family, Senior Citizen, Critical Illness

Multibrand Health Insurance Plans Online Trade Information

- Minimum Order Quantity

- 1 Set

- Main Domestic Market

- All India

About Multibrand Health Insurance Plans Online

We at BharatSIP offer Online Best Health Insurance Plans from Multiple companies of repute for you to compare select best suitable plan.

We give multiple detailed quot.

We also offer GST invoices

Comprehensive Coverage from Top Brands

Access health insurance plans from multiple renowned insurance companies in India, all in one place. Multibrand Health Insurance Plans Online allows you to compare benefits, premiums, and coverage options easily, helping you make the most informed decision for yourself or your family.

Flexible Premium Payment Options

Enjoy total control over your finances by choosing the premium payment mode and schedule that suit you best. Whether you prefer credit card, debit card, net banking, or UPI, and monthly, quarterly, or annual payments-this platform caters to your preferences while ensuring your policy stays active.

Instant Policy Issuance and Hassle-Free Claims

Upon successful payment, your policy document is instantly available for download. With a fully digital claim submission portal and a fast, transparent settlement process, managing claims has never been easier. Round-the-clock customer support adds further peace of mind.

FAQ's of Multibrand Health Insurance Plans Online:

Q: How can I purchase a Multibrand Health Insurance Plan online?

A: You can purchase a plan by accessing the easy comparison dashboard, selecting your desired policy from leading insurance brands, filling in your details, and making payment via credit card, debit card, net banking, or UPI. Upon successful payment, your policy is issued instantly.Q: What types of health insurance policies are available on the platform?

A: The platform offers a variety of policy types including individual, family, senior citizen, and critical illness plans. Coverage amount and policy features are customizable to suit your specific health and financial needs.Q: Which payment modes and schedules can I choose for my premium?

A: Premiums can be paid through credit card, debit card, net banking, or UPI. You may opt for monthly, quarterly, or annual payment cycles, giving you flexibility in managing your financial commitments.Q: What inclusive benefits do these health insurance plans provide?

A: All plans offer comprehensive benefits such as cashless hospitalization at network hospitals, preventive health checkups, as well as pre- and post-hospitalization coverage, ensuring all-round protection for you and your loved ones.Q: What documents are required to purchase a policy?

A: Only basic identification documents are needed to purchase a policy online. You will be guided through the document upload process during your application.Q: How is the claim process managed on this platform?

A: Claims can be submitted digitally through the dedicated claim submission portal. The platform facilitates fast, hassle-free settlement, and customer support is available 24x7 to assist you at every step.Q: Who is eligible for these health insurance plans?

A: Indian residents aged between 18 and 65 years can apply for health insurance using the Multibrand Health Insurance Plans Online service.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Health Insurance Services Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry