Insurance And Fixed Monthly Income Plan Service

Insurance And Fixed Monthly Income Plan Service Specification

- Duration

- Customizable Payment Term (As Per Plan)

- Processing Fees

- As per policy terms

- Policy Issuance Time

- Fast Processing (Usually within a few days)

- Maximum Entry Age

- 65 years

- Service Mode

- Online/Offline

- Product Type

- Insurance And Fixed Monthly Income Plan Service

- Tax Benefit

- Eligible under section 80C/10(10D) (as per applicable law)

- Service Type

- Financial Planning

- Claim Settlement Ratio

- As per insurers statistics

- Minimum Entry Age

- 18 years

- Sum Assured

- As selected by policyholder

- Medical Exam Requirement

- Depends on sum assured and age

- Eligibility

- Individuals meeting insurer's criteria

- Nomination Facility

- Available

- Policy Surrender Option

- Available as per policy terms

- Payment Mode

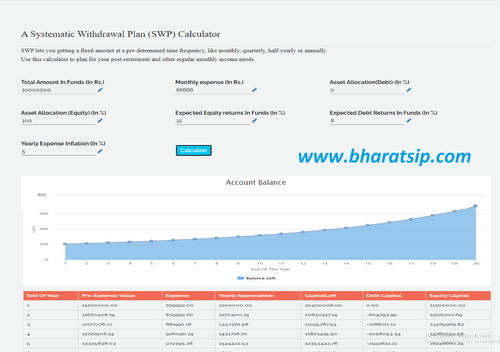

- Monthly/Quarterly/Half Yearly/Annually

- Renewal Facility

- Available with flexible options

- Coverage Type

- Multiple Risk Coverages with Fixed Income

- Location

- Pan India

- Customer Support

- 24x7 Helpline

- Documentation Required

- ID Proof, Address Proof, Income Proof

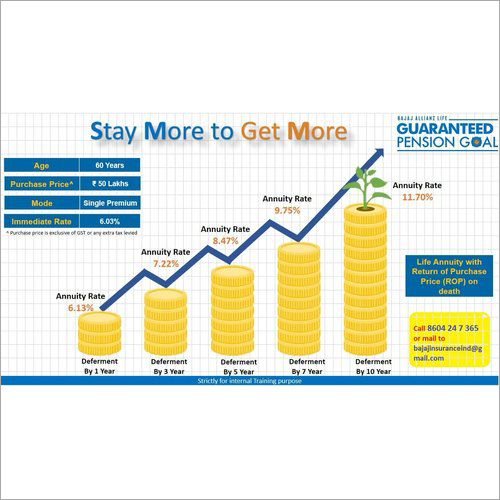

- Monthly Income

- Guaranteed Fixed Amount

About Insurance And Fixed Monthly Income Plan Service

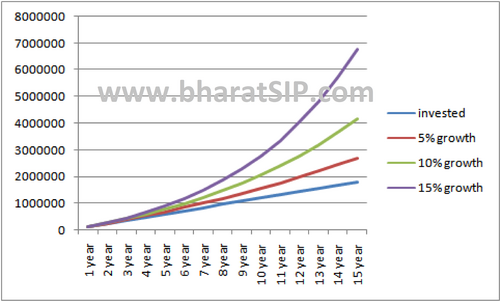

Step into the spotlight with our distinguished Insurance And Fixed Monthly Income Plan Service, a venerable solution combining redoubtable protection with reliable fixed returns. Pick yours from flexible options tailored to your needs-whether for family security, tax benefit, or financial planning, we've got you covered. Order now and enjoy customizable payment terms, broad coverage options, and a seamless application experience. The plan ensures tax benefits under section 80C/10(10D) and features a fast policy issuance, eligibility from 18 to 65 years, and dedicated 24x7 support across India.

Comprehensive Application & Distinctive Advantages

Our Insurance And Fixed Monthly Income Plan Service shines in financial provisioning for individuals seeking both protection and steady income. Plant Application is suitable for employees, professionals, and business owners across India (Pan India). Its area of application spans family security, wealth preservation, and tax-efficient returns. Enjoy primary competitive advantages, such as flexible policy customization, multiple risk coverages, renowned claim settlement ratios, online/offline servicing, and risk-mitigated guaranteed monthly income.

Streamlined Payment & Delivery Terms

Premium payments can be made monthly, quarterly, half-yearly, or annually-whichever best suits your cash flow. With main domestic market coverage across India and convenient online/offline modes, your insurance policy is swiftly dispatched via secure digital delivery or in-person service. Goods transport is not required. Fast processing means documents are verified and the policy is issued within days from our respected FOB port, ensuring efficient onboarding and peace of mind.

Comprehensive Application & Distinctive Advantages

Our Insurance And Fixed Monthly Income Plan Service shines in financial provisioning for individuals seeking both protection and steady income. Plant Application is suitable for employees, professionals, and business owners across India (Pan India). Its area of application spans family security, wealth preservation, and tax-efficient returns. Enjoy primary competitive advantages, such as flexible policy customization, multiple risk coverages, renowned claim settlement ratios, online/offline servicing, and risk-mitigated guaranteed monthly income.

Streamlined Payment & Delivery Terms

Premium payments can be made monthly, quarterly, half-yearly, or annually-whichever best suits your cash flow. With main domestic market coverage across India and convenient online/offline modes, your insurance policy is swiftly dispatched via secure digital delivery or in-person service. Goods transport is not required. Fast processing means documents are verified and the policy is issued within days from our respected FOB port, ensuring efficient onboarding and peace of mind.

FAQ's of Insurance And Fixed Monthly Income Plan Service:

Q: How does the Insurance And Fixed Monthly Income Plan Service provide financial security?

A: This service combines multiple risk coverages with a guaranteed fixed monthly income, giving policyholders both protection and predictable returns to support ongoing expenses and long-term goals.Q: What documents are required to complete the policy issuance process?

A: To purchase the plan, you typically need to provide identity proof, address proof, and income proof, with any necessary processing fees subject to policy terms.Q: When will the policy be issued after submitting the required documents?

A: Policy issuance is fast and usually takes only a few days, provided all required documentation and payments are in order.Q: Where can I access customer support for this plan?

A: You'll have access to 24x7 customer helpline support, available pan India, for all your queries and policy servicing needs.Q: What are the tax benefits associated with this insurance plan?

A: The plan is eligible for tax benefits under sections 80C and 10(10D) of the Income Tax Act, subject to the laws in force and policy terms.Q: How can I surrender my policy if required?

A: Policy surrender is allowed according to the terms of your chosen plan, ensuring flexibility if your financial needs change.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Income Plan Service Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry