ELLS SIP investment online

Price 1000000 INR/ Set

MOQ : 1 Set

ELLS SIP investment online Specification

- Customer Reviews

- 4.8/5 (500+ ratings)

- Mobile Application

- Available

- User Dashboard

- Personal Investment Tracking

- Notifications

- Automated alerts for SIP schedules

- Type

- SIP Investment

- Account Opening Required

- Yes

- Investment Platform

- ELLS

- Integration

- Compatible with popular banks

- Transaction Security

- SSL Encryption

- Product Name

- ELLS SIP investment online

- Plan Customization

- Allowed (frequency & amount)

- Customer Support

- 24/7 online assistance

- Document Requirement

- PAN Card, Address Proof, Bank Details

- Eligibility

- Indian Residents above 18 years

- Service Type

- Online

- Processing Time

- Instant SIP registration

About ELLS SIP investment online

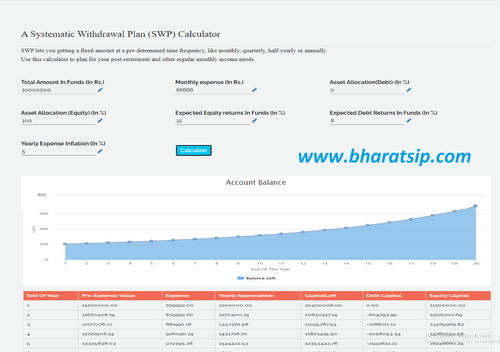

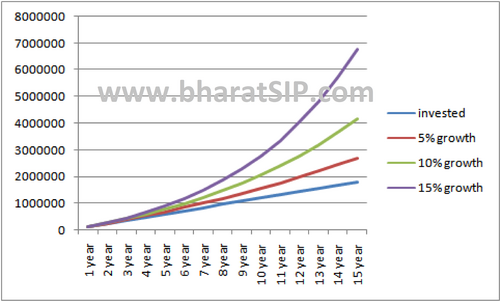

we at bharatsip offer online investment in ELSS instruments of your choice to save tax upto 46800/- per year under section 80C.

You will also get on an average 10% per annum compount intrest on investment with a lockin period of 3 years.

Instant, Secure SIP Registration

Experience immediate SIP account setup with SSL-encrypted transaction security on ELLS. The process is straightforward-just provide your PAN card, address proof, and bank details online for instant activation. The platform's seamless integration with leading banks ensures your investments are processed securely, offering both reliability and peace of mind.

Personalized Investment Control

ELLS allows you to tailor your SIP plan according to your needs, selecting how often and how much to invest. Every user receives access to a personalized dashboard, tracking investments and returns in real time. Automated notifications keep you updated on SIP schedules, helping you stay organized and informed about your portfolio.

Reliable Support 24/7

Our dedicated support team is available around the clock via online channels to address queries or provide necessary assistance. Whether you need help with account setup, transaction issues, or plan customization, ELLS ensures swift and helpful service whenever you need it.

FAQ's of ELLS SIP investment online:

Q: How do I start investing in SIP through ELLS online?

A: To begin your SIP investment with ELLS, register an account on the platform, submit your PAN card, address proof, and bank details, then customize your SIP plan. Registration and activation are immediate, enabling instant investment.Q: What makes ELLS SIP investment online secure for transactions?

A: The platform utilizes SSL encryption to protect all transaction data, ensuring your financial information remains confidential and secure throughout every stage of the investment process.Q: When will my SIP be activated after registration?

A: Upon successful submission of required documents and details, your SIP registration is processed instantly. You can start tracking your investments immediately through your dashboard.Q: Where can I access customer support if I encounter any issues?

A: ELLS offers 24/7 customer support via online chat, email, and the mobile application, making assistance available whenever you need help or have questions.Q: What documents are required for account opening?

A: You need to upload your PAN card, a valid address proof, and your bank details during the account opening process to comply with regulatory requirements.Q: How can I customize my SIP plan on ELLS?

A: The platform allows you to choose both the frequency and the amount for your SIP according to your financial goals. Use the dashboard to adjust settings as needed at any time.Q: What are the benefits of using ELLS SIP investment online?

A: Users enjoy instant registration, advanced security features, investment tracking, customizable plans, automated notifications, and highly-rated customer service. These features make ELLS a leading choice for online SIP investments in India.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Income Plan Service Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry