Systematic Investment Plan SIP

MOQ : 1 Nos, Nos, Unit

Systematic Investment Plan SIP Specification

- Documentation Required

- PAN, KYC, Bank Details

- Portfolio Allocation

- Equity, Debt, Hybrid Funds

- Usage

- Investment Method

- Top-Up Feature

- Permitted in many SIPs

- Withdrawal Flexibility

- Partial or Full Withdrawal Option

- Cut-off Timing

- As per SEBI regulations

- Online Access

- Yes

- Liquidity

- High (subject to fund type)

- Investment Mode

- Monthly, Quarterly, or Customisable

- Eligible Investors

- Residents and NRIs

- Product Type

- Systematic Investment Plan (SIP)

- Tax Benefit

- Available on select funds (ELSS)

Systematic Investment Plan SIP Trade Information

- Minimum Order Quantity

- 1 Nos, Nos, Unit

- Payment Terms

- Telegraphic Transfer (T/T)

- Supply Ability

- 100000 Units Per Day

- Delivery Time

- 1 Hours

- Sample Available

- No

- Certifications

- NISM

About Systematic Investment Plan SIP

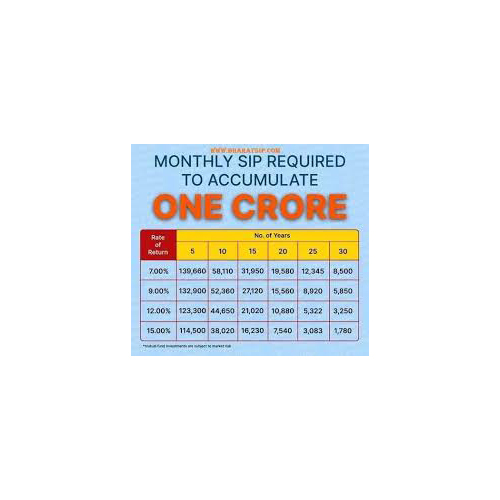

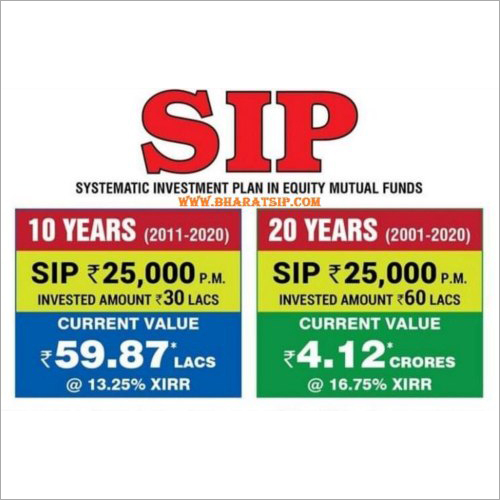

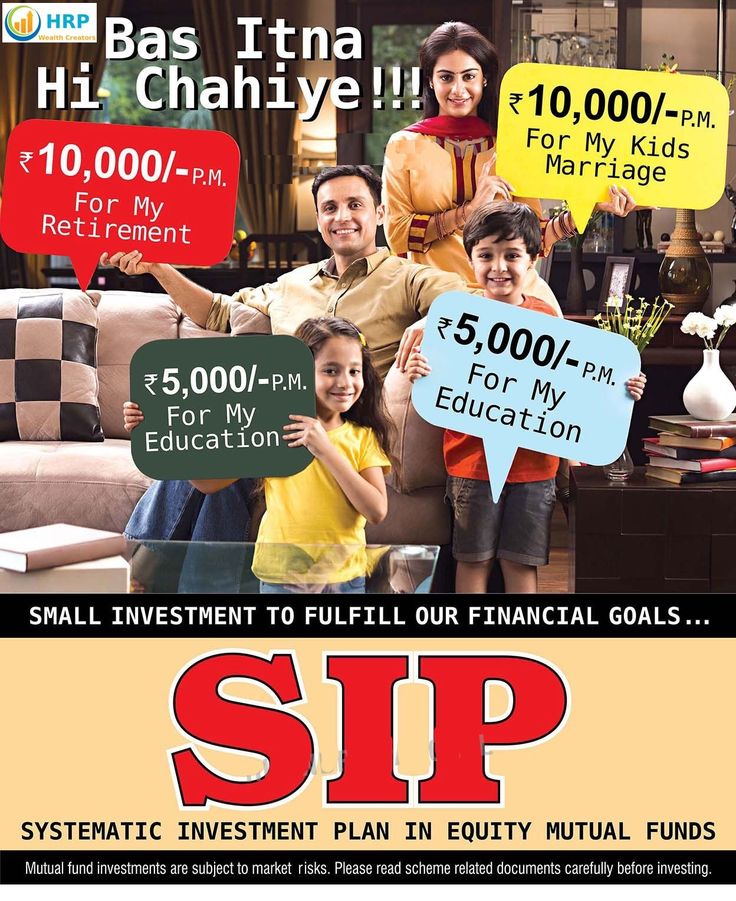

Experience a cost-effective way to generate wealth with our peerless Systematic Investment Plan (SIP). Highly favored by investors, SIPs offer flexibility in investment modes-choose monthly, quarterly, or customizable options. Terrific reviews back the plan's suitability for Residents and NRIs alike, enabling diverse portfolio allocations across equity, debt, or hybrid funds. Liquidity remains high (as per fund category), while select funds may provide tax benefits. Enjoy majestic online access, withdrawal flexibility, and the opportunity to top up, making this a scarce investment opportunity with outstanding features!

Special Features of Systematic Investment Plan (SIP)

A SIP stands out due to its customizable investment frequency, from monthly or quarterly to bespoke schedules, offering you supreme flexibility. It's a majestic option for both Residents and NRIs who seek diversified exposure through equity, debt, or hybrid funds. With high liquidity, online transaction access, partial or full withdrawal options, and permitted top-ups, this plan is a cost-effective strategy used as an ongoing investment method, favored for steady wealth accumulation in India's dynamic market.

Sample Policy, Payment Terms & Packaging Details for SIP

A Systematic Investment Plan (SIP) policy outlines the minimum investment rate, sale price dynamics for chosen funds, and frequency-be it monthly, quarterly, or customized. Payments are typically dispatched via automated transfers, ensuring timely investments. SIP documentation includes PAN, KYC, and bank details, packaged for user-friendly setup. The entire process, from enrollment to dispatching payments, follows SEBI regulations for cut-off timings and transparency, making it a reliable choice for disciplined investors seeking streamlined financial growth.

Special Features of Systematic Investment Plan (SIP)

A SIP stands out due to its customizable investment frequency, from monthly or quarterly to bespoke schedules, offering you supreme flexibility. It's a majestic option for both Residents and NRIs who seek diversified exposure through equity, debt, or hybrid funds. With high liquidity, online transaction access, partial or full withdrawal options, and permitted top-ups, this plan is a cost-effective strategy used as an ongoing investment method, favored for steady wealth accumulation in India's dynamic market.

Sample Policy, Payment Terms & Packaging Details for SIP

A Systematic Investment Plan (SIP) policy outlines the minimum investment rate, sale price dynamics for chosen funds, and frequency-be it monthly, quarterly, or customized. Payments are typically dispatched via automated transfers, ensuring timely investments. SIP documentation includes PAN, KYC, and bank details, packaged for user-friendly setup. The entire process, from enrollment to dispatching payments, follows SEBI regulations for cut-off timings and transparency, making it a reliable choice for disciplined investors seeking streamlined financial growth.

FAQ's of Systematic Investment Plan SIP:

Q: How does a Systematic Investment Plan (SIP) work?

A: A SIP allows you to invest a fixed amount at regular intervals-monthly, quarterly, or as customized-into your chosen mutual funds. Funds are automatically debited from your linked bank account and allocated based on your selected portfolio, helping you build wealth systematically.Q: What documents are required to start a SIP in India?

A: To initiate a SIP, you will need your PAN card, KYC-compliant status, and valid bank account details. These documents are necessary to comply with SEBI guidelines and ensure seamless investment and withdrawals.Q: When can I withdraw money from my SIP investments?

A: You may withdraw partially or fully from your SIP, depending on the liquidity conditions of your chosen fund. For highly liquid funds, there is flexibility to access your investments as per your needs, subject to any applicable lock-in or exit loads.Q: Where can eligible investors access and manage their SIP online?

A: Eligible investors, including Residents and NRIs, can conveniently access and manage SIP accounts through secure online platforms provided by their mutual fund service providers, making tracking and modifying investments effortless.Q: What are the top benefits of investing through a SIP?

A: SIPs offer benefits such as cost-effectiveness, favorable long-term returns, potential tax savings in select plans (like ELSS), and disciplined wealth accumulation. The ability to top up investments and the flexibility in withdrawal options add further value.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry