Medical Insurance

MOQ : 1 Set

Medical Insurance Specification

- Payment Mode

- Online/Offline

- Claim Process

- Cashless & reimbursement options

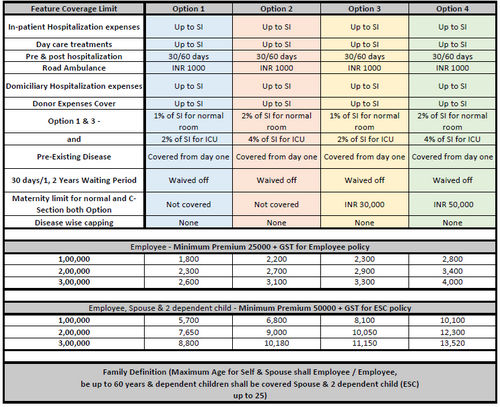

- Plan Flexibility

- Customizable sum insured, add-on riders available

- Network Hospitals

- Wide network of empaneled hospitals

- Usage/Application

- Industrial, Personal, Commercial

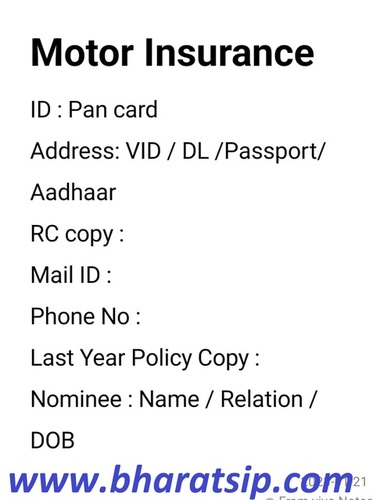

- Document Requirement

- Identity proof, address proof, medical records as needed

- Policy Coverage

- Inpatient and outpatient hospitalization, pre-existing diseases, accidental coverage

- Eligibility

- Individuals aged 18 and above, families, and senior citizens

- Service Type

- Insurance For Medical Needs

- Product Name

- Medical Insurance

- Renewal

- Easy online and offline renewal available

- Premium Payment Frequency

- Monthly, quarterly, annual

- Service Duration

- As Per Requirement

- Customer Support

- 24/7 assistance helpline

Medical Insurance Trade Information

- Minimum Order Quantity

- 1 Set

- Payment Terms

- Others

- Supply Ability

- 1000 Sets Per Day

- Delivery Time

- 1 Hours

- Main Domestic Market

- All India

About Medical Insurance

Jump on this Blue-ribbon Medical Insurance now offered on Clearance! Designed as a must-have solution, it boasts superb policy coverage for inpatient and outpatient hospitalization, pre-existing diseases, and accidental coverage. Suitable for individuals aged 18+, families, and senior citizens, it delivers first-class plan flexibility with customizable sums insured and add-on riders. Enjoy seamless claims with cashless and reimbursement options across a wide network of empaneled hospitals. Premiums can be paid monthly, quarterly, or annually, and renewal is available both online and offline. Supported by 24/7 customer assistance, this top-tier insurance is ideal for industrial, personal, and commercial needs nationwide.

First-class Features and Application Surfaces

Medical Insurance excels with superb features including comprehensive coverage, flexible plans, and a wide hospital network. Perfect for machine operators, plant personnel, and varied industrial roles, it provides essential health protection on workplace surfaces, commercial settings, and individual applications. The policy adapts for diverse service durations and needs, assuring robust health security where required.

Packaging, Sample Policies, and Easy Exchange Process

Upon policy handover, Medical Insurance details are securely dispatched to each customer. Sample policies are readily available for review, enabling informed decisions before purchase. Should a change be needed, policies are seamlessly exchanged or upgraded as per requirements. Comprehensive packaging includes all necessary documentation, making the policy process smooth from sample selection to final handover.

First-class Features and Application Surfaces

Medical Insurance excels with superb features including comprehensive coverage, flexible plans, and a wide hospital network. Perfect for machine operators, plant personnel, and varied industrial roles, it provides essential health protection on workplace surfaces, commercial settings, and individual applications. The policy adapts for diverse service durations and needs, assuring robust health security where required.

Packaging, Sample Policies, and Easy Exchange Process

Upon policy handover, Medical Insurance details are securely dispatched to each customer. Sample policies are readily available for review, enabling informed decisions before purchase. Should a change be needed, policies are seamlessly exchanged or upgraded as per requirements. Comprehensive packaging includes all necessary documentation, making the policy process smooth from sample selection to final handover.

FAQ's of Medical Insurance:

Q: How can I customize my Medical Insurance plan coverage?

A: You can tailor your Medical Insurance coverage by selecting the sum insured and adding riders suited to your health and financial needs, ensuring personalized protection.Q: What documents are needed to apply for Medical Insurance?

A: Applicants must provide identity proof, address proof, and relevant medical records. These documents facilitate policy issuance and seamless claim processing.Q: When does my Medical Insurance coverage begin after payment?

A: Insurance coverage typically starts as soon as your application is approved and the premium payment is processed, subject to policy terms and conditions.Q: Where can I use my Medical Insurance for hospitalization?

A: You can utilize Medical Insurance at any facility within the network of empaneled hospitals nationwide, ensuring wide accessibility for treatment.Q: What is the claim process for inpatient or accidental cases?

A: Claims can be processed either cashless at network hospitals or via reimbursement for expenses incurred, depending on your chosen method and hospital participation.Q: How do I renew my Medical Insurance policy?

A: Renewal is easy, available both online via the insurer's portal and offline at physical branches, keeping your coverage continuous and hassle-free.Q: What are the benefits of using Medical Insurance for industrial applications?

A: Medical Insurance offers robust coverage to machine operators and plant personnel, safeguarding health, reducing downtime, and supporting occupational wellness in industrial environments.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Insurance Services Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry