Pension Plans Guaranteed Service

Pension Plans Guaranteed Service Specification

- Maturity Benefit

- Guaranteed

- Customer Support

- 24/7 Assistance

- Policy Renewal

- Available Online

- Service Provided By

- Insurance Company

- Plan Type

- Retirement/Pension Plan

- Claim Settlement Ratio

- High (Varies by Provider)

- Tax Benefit

- As per Income Tax Laws

- Withdrawal Option

- Partial Withdrawal Allowed as per Policy Terms

- Minimum Entry Age

- 18 Years

- Service Mode

- Online / Offline

- Service Type

- Pension Plans Guaranteed Service

- Duration

- Customized as per Policy

- Maximum Entry Age

- 70 Years

- Service Location

- Pan India

- Payment Frequency

- Monthly/Quarterly/Half-Yearly/Yearly

About Pension Plans Guaranteed Service

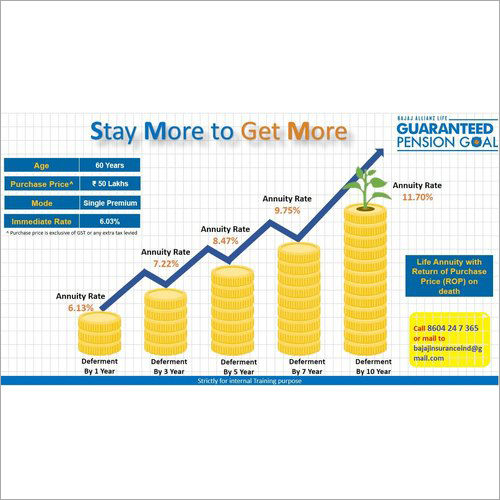

Pension Plans Guaranteed Service offers individuals a guaranteed income after their retirement. With this service, individuals can invest a certain amount of money, either in lump-sum or in regular installments, and receive a fixed and guaranteed income for the rest of their lives or for a specified period. This Pension Plans Guaranteed Service is designed to provide a stable and secure retirement income to individuals and help them plan their retirement with confidence. This service comes with various features and benefits.

Comprehensive Coverage Across India

The Pension Plans Guaranteed Service is accessible to residents across India, ensuring that individuals from various regions can leverage a robust retirement solution. With online and offline service modes, policyholders benefit from streamlined processes and personalized assistance, reinforcing a seamless experience from enrollment to claim settlement.

Flexible Payment and Withdrawal Options

Choose payment intervals that best suit your income flow-monthly, quarterly, half-yearly, or yearly. Partial withdrawals are permitted, aligning with specific policy terms, thereby providing financial flexibility during unforeseen circumstances or milestone events within your retirement journey.

Reliable Support and Guaranteed Maturity

Benefit from 24/7 customer support and easy online policy renewal, which simplify maintenance and inquiries. The plan's guaranteed maturity benefit assures you of a secure payout upon policy completion, and high claim settlement ratios by insurance companies underpin your peace of mind.

FAQ's of Pension Plans Guaranteed Service:

Q: How can I enroll in the Pension Plans Guaranteed Service and what are the entry age criteria?

A: You can enroll in this pension plan either online or offline through authorized insurance company channels. The entry age is flexible, allowing individuals aged between 18 and 70 years to become policyholders.Q: What payment frequencies are available and how do I select the right one for my needs?

A: You may choose to pay your premiums monthly, quarterly, half-yearly, or yearly. The selection can be made at the time of enrollment, based on your income pattern and convenience.Q: When and how can I access partial withdrawals from my pension plan?

A: Partial withdrawals are permitted as per the specific terms of your chosen policy. You can initiate withdrawal requests online or offline, subject to the policy's minimum and maximum withdrawal limits.Q: Where can I renew my pension plan policy and access customer support services?

A: Policy renewal and customer support are available online via the insurance provider's platform or offline at their service centers. Support services are operational 24/7 for all policy-related queries.Q: What is the process for claiming the maturity benefit and what does 'guaranteed' mean?

A: Upon completion of your policy term, you can submit a maturity claim to your insurance provider using their online portal or service centers. 'Guaranteed' means the maturity benefit amount promised at policy inception will be paid, regardless of market changes.Q: What tax advantages are associated with this pension plan?

A: Tax benefits are granted as per prevailing Income Tax Laws in India. Typically, premiums paid and maturity amounts may qualify for deductions and exemptions, though these are subject to government tax regulations.

Tell us about your requirement

Price:

Quantity

Select Unit

- 50

- 100

- 200

- 250

- 500

- 1000+

Additional detail

Mobile number

Email

More Products in Pension Plans Category

Om Xpress Print Pack Pvt. Ltd

GST : 36AABCO5038J1ZD

GST : 36AABCO5038J1ZD

B No B-3/2, 1, SD Road, Secunderabad,Secunderabad - 500003, Telangana, India

Phone :08045816872

|

|

Bharat SIP

All Rights Reserved.(Terms of Use) Developed and Managed by Infocom Network Private Limited. |

Send Inquiry

Send Inquiry